Greensboro Legal Blog

Why the 2024 HIPAA Final Rule?

The 2024 HIPAA Final Rule addresses the new prohibitions against using or disclosing PHI since the overturning Roe v. Wade.

FIRPTA – It’s Not What You Think!

FIRPTA (the Foreign Investment in Real Property Tax Act): What it is and how it affects realtors, buyers, and sellers.

Are Noncompete Agreements Banned in NC?

Noncompete agreements will be banned in NC if a new federal rule goes into effect.

How Estates Affect Real Estate Closings – Topic 4: Notice to Creditors

Topic 4 in “How Estates Affect Real Estate Closings” deals with the Notice to Creditors. This notice must be published at least once before the closing of real property.

NCMB’s Guidelines on Telemedicine

The North Carolina Medical Board (NCMB) recognizes the potential benefits of telemedicine and recently updated its position statement.

How Estates Affect Real Estate Closings – Topic 3: Determining Heirs

Topic 3: “How Estates Affect Real Estate Closings” with determining heirs or beneficiaries of the decedent. It is necessary to identify heirs and whether they are married.

2024 Revolution Law Pickleball Open

For the second year in a row, Revolution Law Group is excited to sponsor the Revolution Law Open! The tournament will take place May 3rd through the 5th at the Lawndale Club in...

How Estates Affect Real Estate Closings – Topic 2: Location, Location, Location!

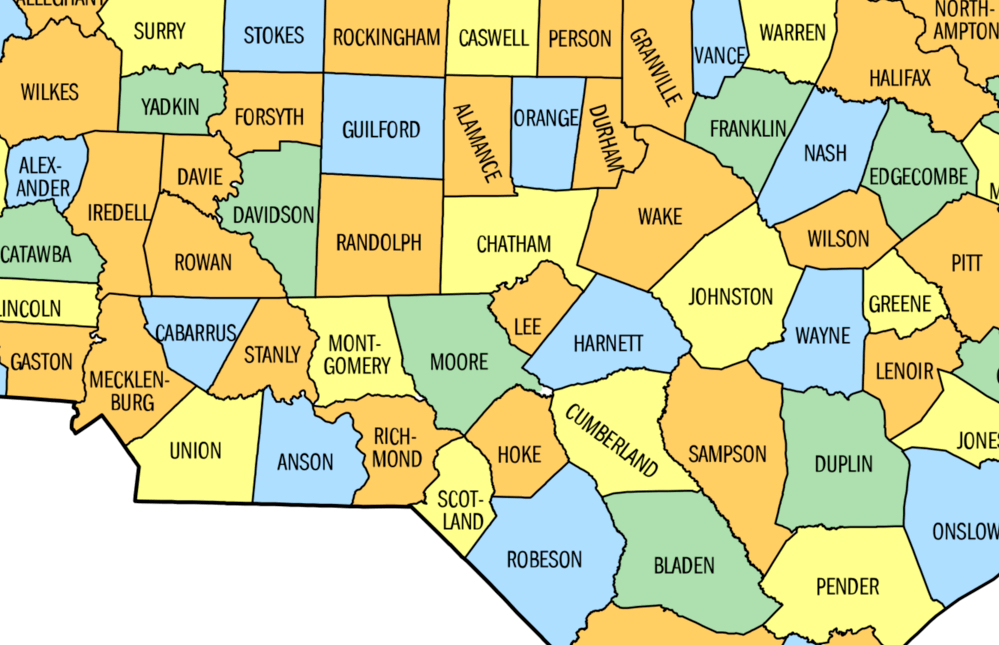

The next step is confirming if an estate file has been opened and, if so, that filings have been submitted in the appropriate county. For any transfer or sale of real property to be valid against claims of creditors, the decedent owner’s will must be probated or filed in the county where the property is located.

Who Owns That Ghost Town Amusement Park? The Importance of an Operating Agreement

Essential facts of the operating agreement in the case of McLure v. Ghost Town in the Sky, LLC, an amusement park in Maggie Valley, NC.

New Rule from the Department of Labor

The DOL announced on 9 Jan 2024 a new rule that replaces the 2021 Independent Contractor Rule and provides guidance on how to analyze who is an employee or independent contractor under the FLSA.