FIRPTA (the Foreign Investment in Real Property Tax Act): What it is and how it affects realtors, buyers, and sellers.

FIRPTA (the Foreign Investment in Real Property Tax Act): What it is and how it affects realtors, buyers, and sellers.

Topic 3: “How Estates Affect Real Estate Closings” with determining heirs or beneficiaries of the decedent. It is necessary to identify heirs and whether they are married.

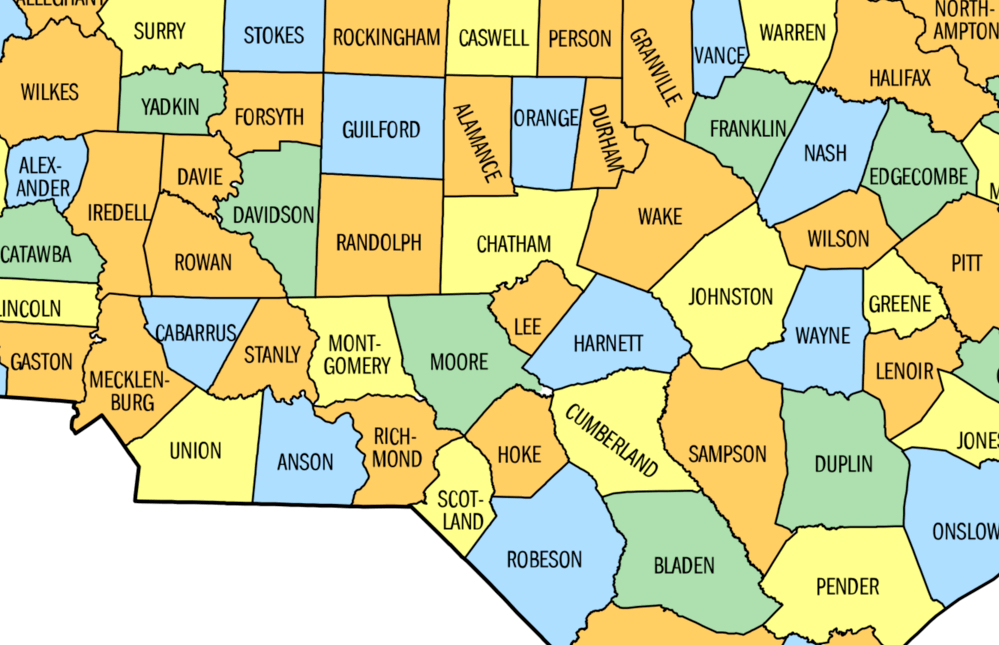

The next step is confirming if an estate file has been opened and, if so, that filings have been submitted in the appropriate county. For any transfer or sale of real property to be valid against claims of creditors, the decedent owner’s will must be probated or filed in the county where the property is located.

Whether a deceased individual had a Last Will and Testament determines how the deceased’s estate will transfer according to North Carolina statute.

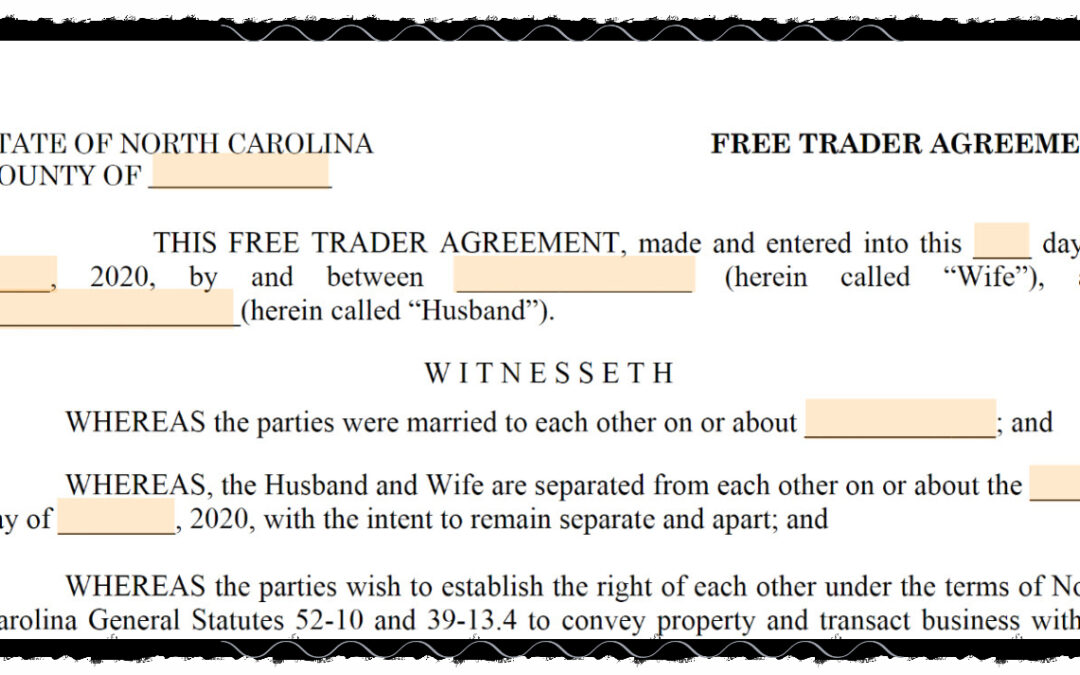

The common “rule” when selling or transferring real property is that both spouses will need to sign the deed, even if the property was purchased prior to marriage. A...

In North Carolina, a married couple is presumed to have a joint interest in real property that is bought or sold during the marriage. A deeper explanation on that topic...

Married or unmarried, that is the question. Are your buyers married and how do they plan to own the property? Here are four legal options to choose from for couples, spouses, and partners.

People’s names change or they differ. And those initials stand for a full name. Its important to know and show the full legal name on closing documents.

Making your life easier by giving you information about things you need to focus on from a closing standpoint.

The deed to your house is in your name only. Does your recent spouse need to sign-off when the house is sold?